VDSC expects fertilizer consumption, especially in the domestic market, to improve in the fourth quarter of 2022 and the first quarter of next year thanks to the upcoming peak season.

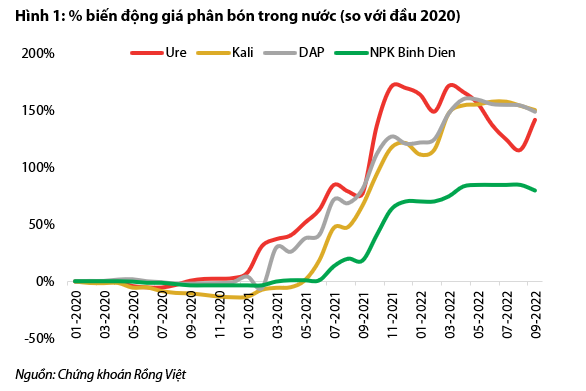

In the recent fertilizer industry update report, Viet Rong Securities (VDSC) assessed that fertilizer prices have cooled down and stayed flat for many months after a sharp increase at the end of the first quarter of 2022 due to the impact of the conflict between Russia – Ukraine.

However, there is a shortage of fertilizer supply in the world, especially Urea in Europe, as a result, urea prices have rebounded since September 2022. Accordingly, VDSC forecasts that the selling price of fertilizers will remain high in the fourth quarter of 2022 when the winter-spring crop begins and lasts through the first quarter of next year.

At the same time, the tension between Russia and Ukraine continues, Russia imposed an export quota of Urea fertilizer at the end of December 2022, and China’s fertilizer exports are restricted, which is likely to increase fertilizer prices. high in the near future.

The third quarter business results season ended, some leading fertilizer manufacturers recorded mixed results. Manufacturing enterprises such as DCM, DPM recorded good profits over the same period while BFC showed a decline.

Specifically, DPM announced Q3/2022 business results with revenue and EAT of parent company shareholders reaching VND 3,930 billion and VND 997 billion, respectively; growth of 38% and 61% respectively over the same period. The reason for the revenue growth came from the fact that the selling prices of key products such as Urea and NPK remained high compared to the same period last year in the context of low consumption volume. According to VDSC’s estimate, the selling price of urea increased by more than 40%, the selling price of NPK increased by more than 50%.

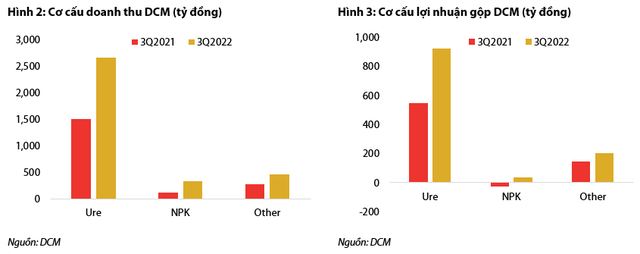

Besides DPM, another giant in the fertilizer industry, DCM, also announced Q3 results with revenue and EAT of parent company shareholders reaching VND 3,458 billion and VND 727 billion, respectively; respectively, growth of 82% and 93% over the same period. Selling prices of products increased and sales volume increased, helping to increase revenue.

Similar to DPM, maintaining high selling prices as well as decreasing input gas prices are factors that help DCM’s gross profit margin stay at a good level. In particular, DCM’s urea export volume was generally much better than the same period last year when urea export revenue reached VND 936 billion, up 213%.

Contrary to the business results of the two giants, BFC’s parent company’s profit after tax fell by 77% over the same period to only 6 billion dong in the third quarter of 2022.

Although BFC recorded a 27% increase in revenue mainly from high fertilizer prices, gross profit margin decreased to 8% compared to 9.8% in the same period last year, due to high competition in the NPK segment and low demand in the domestic market.

With the upcoming Winter-Spring crop, VDSC analysts expect the fertilizer industry’s sales volume, especially in the domestic market, to improve compared to the low season in the third quarter.

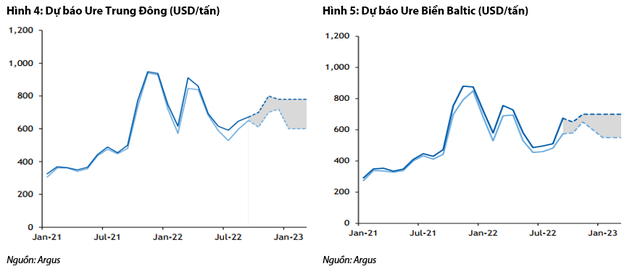

According to Argus’ forecast, Urea price is likely to move sideways in this Q4/2022. Combined with the downward trend in input gas prices of DCM and DPM, VDSC expects Urea business to improve compared to Q3/2022 thanks to higher gross profit margin. Thereby helping to improve the profit in the fourth quarter of the two companies compared to the previous quarter.

For BFC, VDSC said that the business is likely to continue to have a low gross margin like in the third quarter of 2022, but offset the increase in sales volume thanks to the peak season. At that time, BFC’s profit will grow better than in the third quarter of 2022 but it will be difficult to return to the high level as in the first quarters of the year.

Economic life